The Rising Tide

The Rematch: Why Adaptation Beats Adoption Every Time

Jud Mackrill

January 26, 2026

This past week, like many people, I turned on the college football national championship game in Miami between the Hurricanes and Hoosiers. I had just seen Indiana play in person at the Peach Bowl in Atlanta, and in my mind, the difference between them and everybody else was pretty massive. I was expecting them to dominate, but the Hurricanes came to play in their home stadium. It was a great game all the way down to the end—probably one of the best finishes to the college football season anyone could have hoped for.

At the center of this story was the storybook unfolding of Indiana football and Fernando Mendoza. Mendoza carries himself with such professionalism and kindness; it's truly refreshing to see a person bring that to their day-to-day.

But here's the part of the story that I found remarkable.

Same Player. Same Number. Different Outcome.

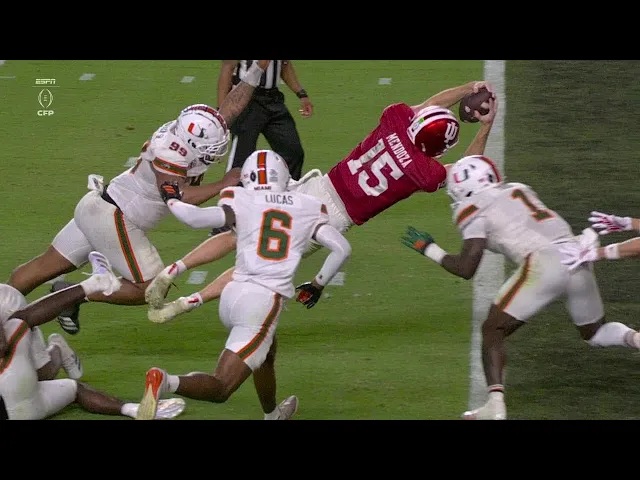

Go back in time with me to the previous season. On October 5, 2024, Mendoza was playing for another team - Cal. As their quarterback, he was facing Miami's Wesley Bissainthe—number 31—who delivered a hit that helped complete the Hurricanes' comeback win. Bissainthe’s tackle of Mendoza wasn't just a play; it was a punctuation mark on a difficult loss.

Fast forward to this year. Mendoza went to Indiana through the transfer portal and was marching his new team through every game to a win. The only game left to play was the national championship and on the other side of the field, stood that same defender - Bissainthe. Same number on his jersey from the previous year. A similar opportunity to punctuate a game, but this time, Mendoza didn’t go down. Instead, he trucked through Bissainthe on a touchdown run that has become one of the defining moments of the game.

Everyone Talks About Adoption. Almost Nobody Talks About Adaptation.

The tech industry and financial services too, love the word "adoption." We measure it. We build onboarding programs around it. We celebrate when a firm "adopts" a new platform, a new CRM, a new reporting tool.

But adoption is just the beginning. Adoption is the next step after signing the contract. It's sitting through the implementation. It's changing rhythms and finding new steps. It’s much more than checking the box that says yes, we have this now.

Adaptation goes even further.

Adaptation is what Mendoza did between October and January. He didn't just join a new team and follow their patterns—he transformed how he played too. He studied film. He understood what went wrong. And this time, when number 31 came at him, he didn't try the same thing and hope for a different result. He lowered his shoulder and kept his feet moving forward.

The Bissainthe Principle

Here's what I'd call the Bissainthe Principle: your biggest obstacles have a habit of showing up again.

The market correction that rattled your client's confidence will return in a different year. The estate planning conversation they avoided will resurface when it's more urgent. The emotional decision-making that cost them money in 2022 will await them in the next downturn.

And here's the hard truth: those obstacles can become definitional. They can either perpetually limit your clients, or your clients can learn from them and overcome. There's no third option where the obstacle just goes away. Because even if it were to never occur again, that obstacle has in some way made its mark.

The same is true for you and your firm. The technology implementation that went sideways. The key employee who left and took clients with them. The merger conversation that fell apart. The growth plateau you couldn't break through. Those moments don't just disappear from the rearview mirror—they shape how you make decisions today, whether you realize it or not.

The question isn't whether you or your clients will face number 31 again. The question is whether you'll have done the work to meet that moment differently.

Your Clients Already Know What Got Them Knocked Down

It’s so common for your client relationships to exist precisely because someone got hit by their own number 31.

Maybe it was a portfolio that wasn't built for the volatility they actually experienced; a tax strategy that looked good on paper until it didn't; a previous advisor who stopped returning calls when the market got hard; an inheritance handled poorly; a business sale where they left money on the table because nobody was quarterbacking the complexity.

They learned a hard lesson, and that lesson is part of why they're sitting across from you now.

The question is: are you helping them just adopt a new advisor, or are you helping them adapt from what they learned?

Because if all you're offering is adoption—new accounts, new allocation, new quarterly reports—you're asking them to believe that this time will be different without showing them why.

Adaptation means something more. It means asking: what broke last time? What did you learn about your own risk tolerance, your own decision-making under pressure, your own blind spots? And how does the plan we're building together specifically address that—not in theory, but in practice?

The clients who thrive with you long-term won't be the ones who simply adopted you as their new advisor. They'll be the ones you helped adapt into better stewards of their own wealth.

The Transformation Test

Here's a simple way to know if you're helping a client adopt or adapt:

If they could swap you out for another advisor and nothing would change about how they make financial decisions, you've helped them adopt.

If working with you has fundamentally changed how they see their own wealth—how they respond to volatility, how they think about risk, how they prepare for the next disruption—you've helped them adapt.

Mendoza didn't just adopt Indiana's playbook. He adapted everything he'd learned from getting knocked down into a version of himself that could truck through the same defender on the biggest stage.

Number 31 Is Coming Back

Whatever knocked your clients down before—the panic selling in a downturn, the advisor who disappeared, the estate plan that fell apart—it's on it’s way. That challenge will show up again, maybe even wearing the same jersey. The next bear market. The next health scare. The next family transition. The next moment where fear tells them to do something they'll regret.

The clients who thrive won't be the ones who adopted the best advisor. They'll be the ones who adapted from what they learned.

Your job isn't just to manage their wealth. It's to help them become the kind of people who are ready for the rematch.

What's your clients' number 31? And what are you doing to make sure they're ready when it comes back around?

The Rising Tide

The Rematch: Why Adaptation Beats Adoption Every Time

Jud Mackrill

January 26, 2026

This past week, like many people, I turned on the college football national championship game in Miami between the Hurricanes and Hoosiers. I had just seen Indiana play in person at the Peach Bowl in Atlanta, and in my mind, the difference between them and everybody else was pretty massive. I was expecting them to dominate, but the Hurricanes came to play in their home stadium. It was a great game all the way down to the end—probably one of the best finishes to the college football season anyone could have hoped for.

At the center of this story was the storybook unfolding of Indiana football and Fernando Mendoza. Mendoza carries himself with such professionalism and kindness; it's truly refreshing to see a person bring that to their day-to-day.

But here's the part of the story that I found remarkable.

Same Player. Same Number. Different Outcome.

Go back in time with me to the previous season. On October 5, 2024, Mendoza was playing for another team - Cal. As their quarterback, he was facing Miami's Wesley Bissainthe—number 31—who delivered a hit that helped complete the Hurricanes' comeback win. Bissainthe’s tackle of Mendoza wasn't just a play; it was a punctuation mark on a difficult loss.

Fast forward to this year. Mendoza went to Indiana through the transfer portal and was marching his new team through every game to a win. The only game left to play was the national championship and on the other side of the field, stood that same defender - Bissainthe. Same number on his jersey from the previous year. A similar opportunity to punctuate a game, but this time, Mendoza didn’t go down. Instead, he trucked through Bissainthe on a touchdown run that has become one of the defining moments of the game.

Everyone Talks About Adoption. Almost Nobody Talks About Adaptation.

The tech industry and financial services too, love the word "adoption." We measure it. We build onboarding programs around it. We celebrate when a firm "adopts" a new platform, a new CRM, a new reporting tool.

But adoption is just the beginning. Adoption is the next step after signing the contract. It's sitting through the implementation. It's changing rhythms and finding new steps. It’s much more than checking the box that says yes, we have this now.

Adaptation goes even further.

Adaptation is what Mendoza did between October and January. He didn't just join a new team and follow their patterns—he transformed how he played too. He studied film. He understood what went wrong. And this time, when number 31 came at him, he didn't try the same thing and hope for a different result. He lowered his shoulder and kept his feet moving forward.

The Bissainthe Principle

Here's what I'd call the Bissainthe Principle: your biggest obstacles have a habit of showing up again.

The market correction that rattled your client's confidence will return in a different year. The estate planning conversation they avoided will resurface when it's more urgent. The emotional decision-making that cost them money in 2022 will await them in the next downturn.

And here's the hard truth: those obstacles can become definitional. They can either perpetually limit your clients, or your clients can learn from them and overcome. There's no third option where the obstacle just goes away. Because even if it were to never occur again, that obstacle has in some way made its mark.

The same is true for you and your firm. The technology implementation that went sideways. The key employee who left and took clients with them. The merger conversation that fell apart. The growth plateau you couldn't break through. Those moments don't just disappear from the rearview mirror—they shape how you make decisions today, whether you realize it or not.

The question isn't whether you or your clients will face number 31 again. The question is whether you'll have done the work to meet that moment differently.

Your Clients Already Know What Got Them Knocked Down

It’s so common for your client relationships to exist precisely because someone got hit by their own number 31.

Maybe it was a portfolio that wasn't built for the volatility they actually experienced; a tax strategy that looked good on paper until it didn't; a previous advisor who stopped returning calls when the market got hard; an inheritance handled poorly; a business sale where they left money on the table because nobody was quarterbacking the complexity.

They learned a hard lesson, and that lesson is part of why they're sitting across from you now.

The question is: are you helping them just adopt a new advisor, or are you helping them adapt from what they learned?

Because if all you're offering is adoption—new accounts, new allocation, new quarterly reports—you're asking them to believe that this time will be different without showing them why.

Adaptation means something more. It means asking: what broke last time? What did you learn about your own risk tolerance, your own decision-making under pressure, your own blind spots? And how does the plan we're building together specifically address that—not in theory, but in practice?

The clients who thrive with you long-term won't be the ones who simply adopted you as their new advisor. They'll be the ones you helped adapt into better stewards of their own wealth.

The Transformation Test

Here's a simple way to know if you're helping a client adopt or adapt:

If they could swap you out for another advisor and nothing would change about how they make financial decisions, you've helped them adopt.

If working with you has fundamentally changed how they see their own wealth—how they respond to volatility, how they think about risk, how they prepare for the next disruption—you've helped them adapt.

Mendoza didn't just adopt Indiana's playbook. He adapted everything he'd learned from getting knocked down into a version of himself that could truck through the same defender on the biggest stage.

Number 31 Is Coming Back

Whatever knocked your clients down before—the panic selling in a downturn, the advisor who disappeared, the estate plan that fell apart—it's on it’s way. That challenge will show up again, maybe even wearing the same jersey. The next bear market. The next health scare. The next family transition. The next moment where fear tells them to do something they'll regret.

The clients who thrive won't be the ones who adopted the best advisor. They'll be the ones who adapted from what they learned.

Your job isn't just to manage their wealth. It's to help them become the kind of people who are ready for the rematch.

What's your clients' number 31? And what are you doing to make sure they're ready when it comes back around?

Phone

+1 (470) 502-5600

Mailing Address

Milemarker

PO Box 262

Isle Of Palms, SC 29451-9998

Legal Address

Milemarker Inc.

16192 Coastal Highway

Lewes, Delaware 19958

Built by Teams In:

Atlanta, Charleston, Cincinnati, Denver, Los Angeles, Omaha & Portland.

Partners

Platform

Solutions

© 2026 Milemarker Inc. All rights reserved

DISCLAIMER: All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.

Phone

+1 (470) 502-5600

Mailing Address

Milemarker

PO Box 262

Isle Of Palms, SC 29451-9998

Legal Address

Milemarker Inc.

16192 Coastal Highway

Lewes, Delaware 19958

Built by Teams In:

Atlanta, Charleston, Cincinnati, Denver, Los Angeles, Omaha & Portland.

Partners

Platform

Solutions

© 2026 Milemarker Inc. All rights reserved

DISCLAIMER: All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.

Phone

+1 (470) 502-5600

Mailing Address

Milemarker

PO Box 262

Isle Of Palms, SC 29451-9998

Legal Address

Milemarker Inc.

16192 Coastal Highway

Lewes, Delaware 19958

Built by Teams In:

Atlanta, Charleston, Cincinnati, Denver, Los Angeles, Omaha & Portland.

Partners

Platform

Solutions

© 2026 Milemarker Inc. All rights reserved

DISCLAIMER: All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.

Phone

+1 (470) 502-5600

Mailing Address

Milemarker

PO Box 262

Isle Of Palms, SC 29451-9998

Legal Address

Milemarker Inc.

16192 Coastal Highway

Lewes, Delaware 19958

Built by Teams In:

Atlanta, Charleston, Cincinnati, Denver, Los Angeles, Omaha & Portland.

Partners

Platform

Solutions

© 2026 Milemarker Inc. All rights reserved

DISCLAIMER: All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.