When Investors Call, Are You Ready to Answer?

Monday morning. Your phone rings.

“We’re interested in discussing an investment. Can you send over your financials?”

Panic mode: Export from six systems. Build spreadsheets. Hope the numbers tell a coherent story.

Two weeks later:

Finally send a patchwork data room that raises more questions than it answers.

The result:

Investors question your operational sophistication before they even evaluate your growth potential.

Your opportunity shouldn’t die in data preparation.

What You Get

Investor Dashboard

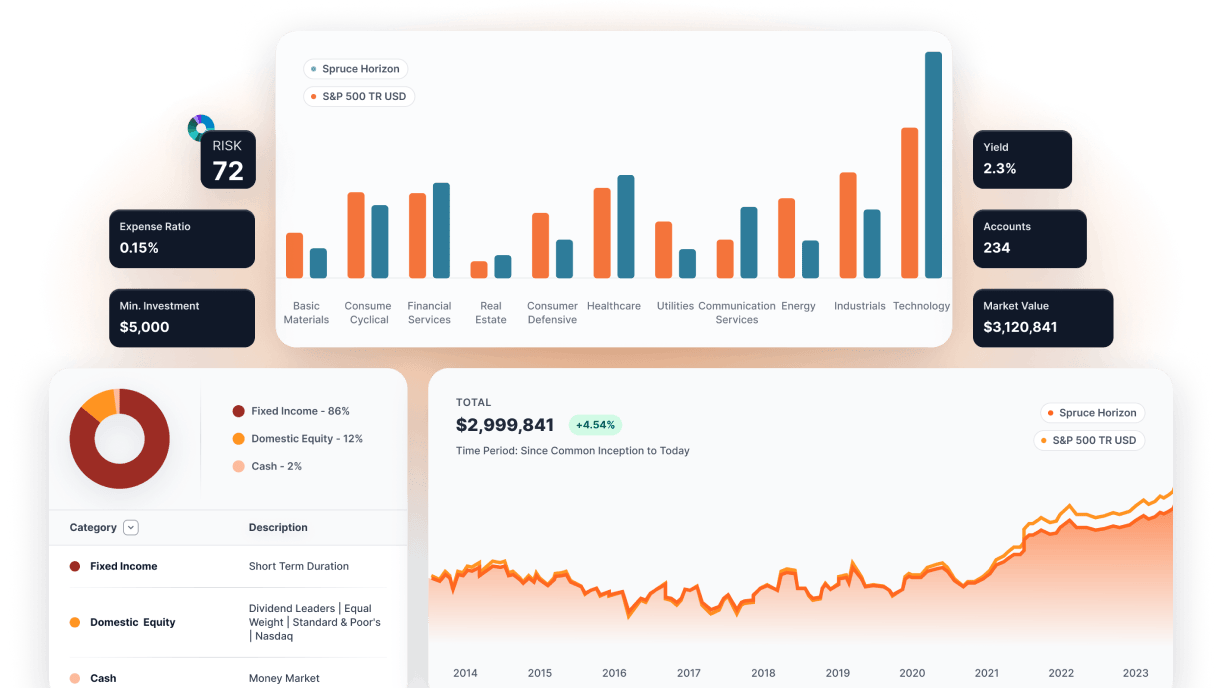

Real-time firm valuation metrics & key performance indicators

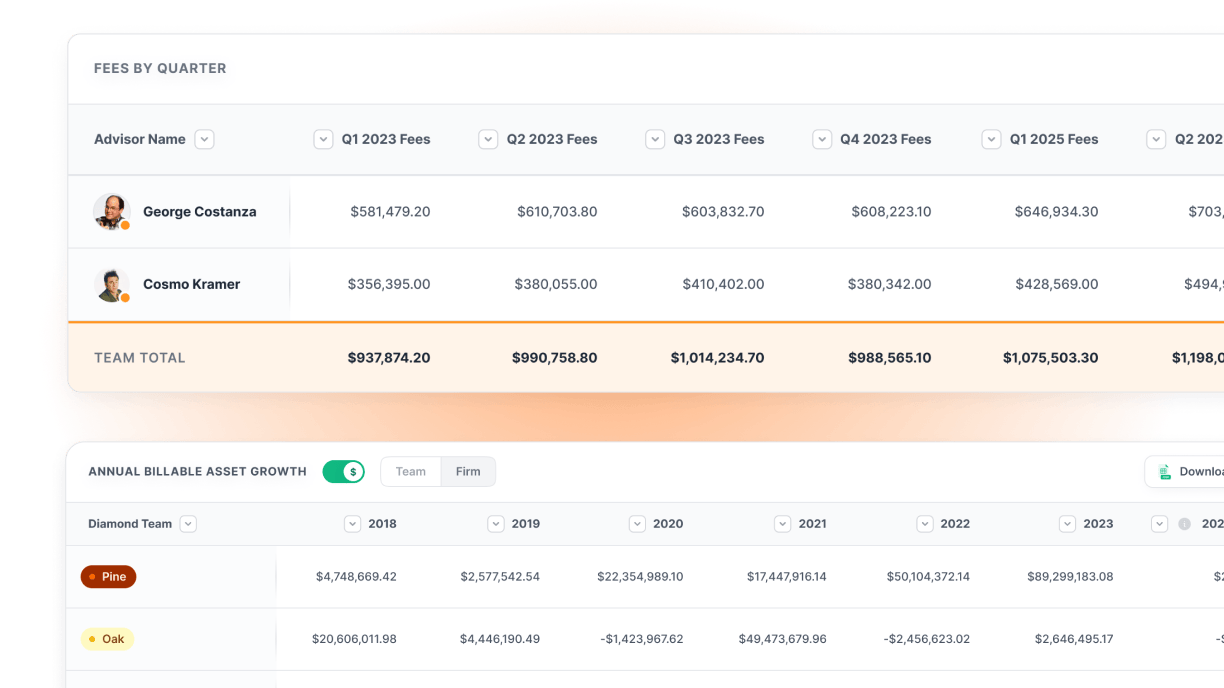

Revenue trends by advisor, office, & service line with growth trajectories

Client acquisition costs, lifetime value, & retention analytics

Operational efficiency metrics that prove scalability

Financial Intelligence

Automated EBITDA calculations with transparent methodology

Margin analysis by business line & geographic region

Cost structure optimization & scalability modeling

Revenue predictability & recurring income analysis

Growth Analytics

Advisor productivity trends & capacity modeling

Market penetration analysis & expansion opportunities

Client wallet share progression & revenue expansion metrics

Acquisition integration success rates & synergy realization

Operational Metrics

Technology ROI & automation effectiveness measurement

Process efficiency benchmarking & improvement tracking

Compliance monitoring with exception management analytics

Resource allocation optimization across all business functions

Due Diligence Package

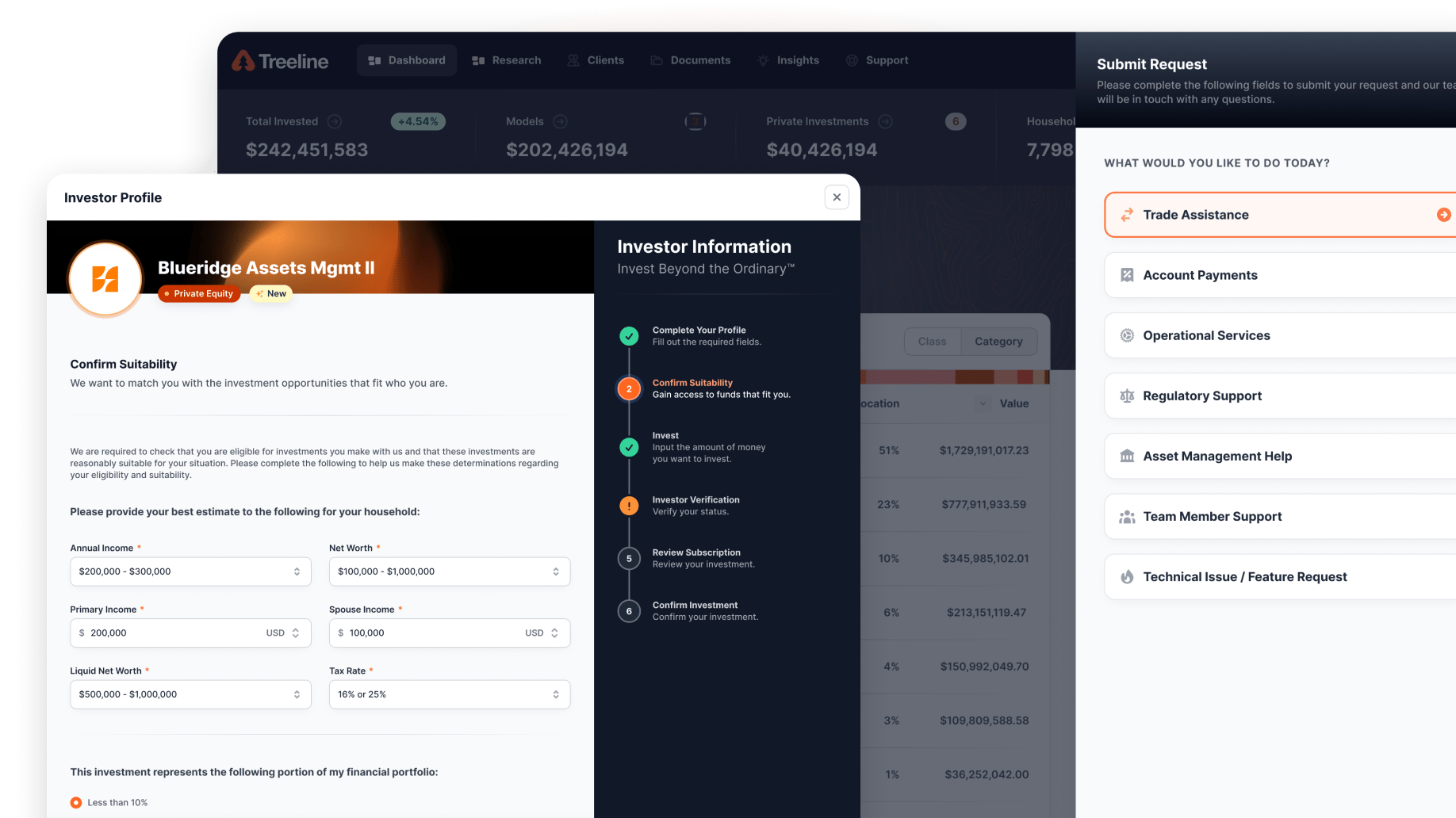

Automated financial reporting with institutional-grade accuracy

Complete operational documentation & process mapping

Historical performance analysis with forward-looking projections

Competitive positioning analysis based on comprehensive data

Investor Inquiries

Professional Data Room Ready In Hours

Due Diligence

Automated Documentation & Transparent Analytics

Growth Story

Predictive Intelligence & Proven Scalability

Valuation Discussions

Confidence Backed By Institutional-Grade Data

Real Results

Capital

Readiness Features

Built For

Institutional Standards

Advanced

Capital Features

Financial Performance Analytics

Margin analysis by business line, geography, & client segment

Cost structure optimization with scalability considerations

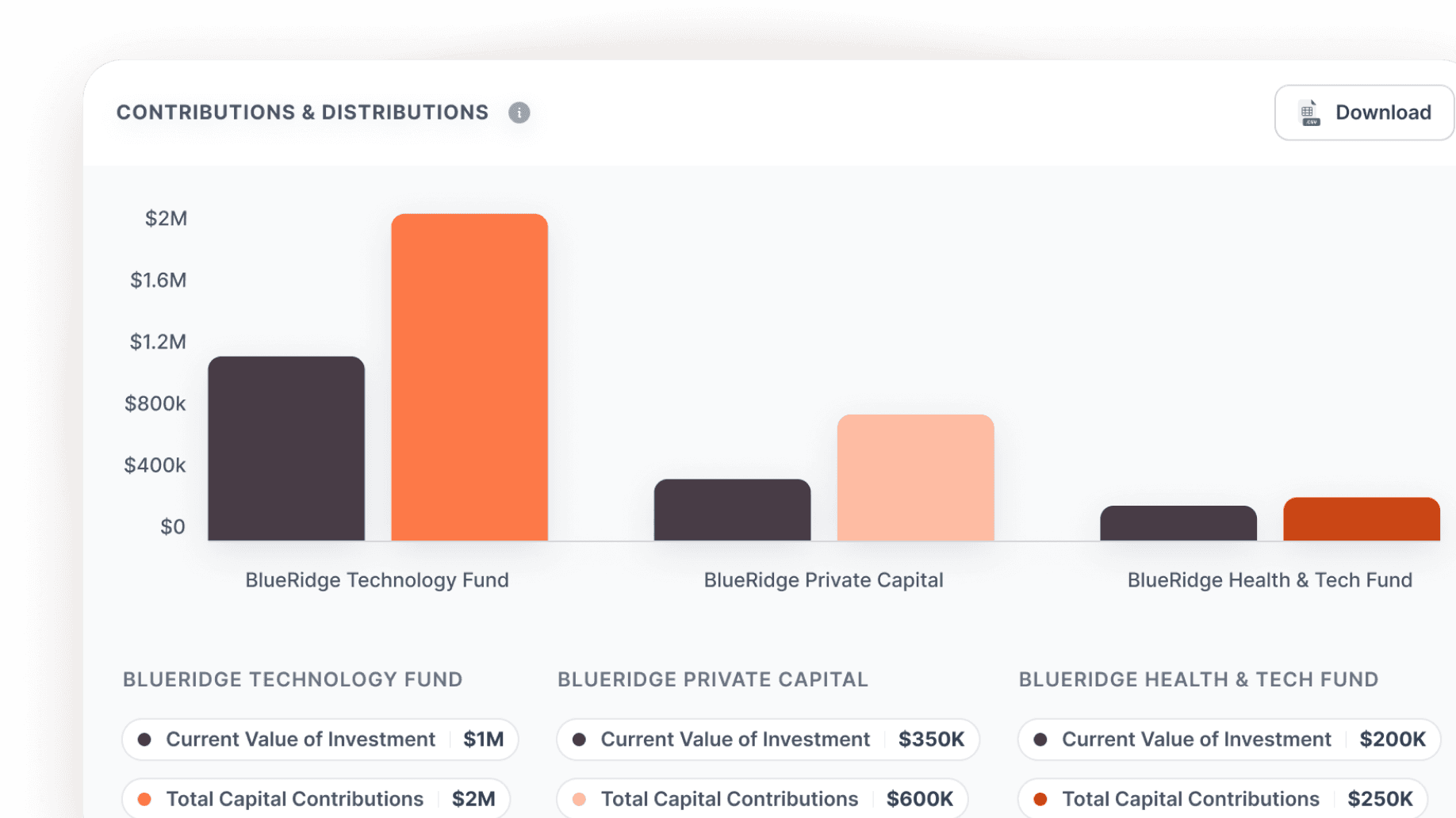

Working capital management & cash flow predictability analysis

Profitability trending with leading indicator identification

Strategic Intelligence

Market opportunity analysis based on current performance data

Competitive advantage identification & sustainable differentiation analysis

Acquisition target identification with integration success modeling

Strategic partnership evaluation & value creation assessment

Operational Excellence Metrics

Process automation ROI & efficiency improvement tracking

Technology investment analysis & strategic infrastructure planning

Resource optimization across all business functions & geographies

Scalability assessment with bottleneck identification & resolution planning

Predictive Intelligence

Revenue forecasting with confidence intervals based on historical performance

Client lifetime value modeling with retention & expansion analytics

Market share analysis & competitive positioning assessment

Growth scenario planning with resource requirement modeling

Why This Matters for Capital

Capital flows to businesses that can prove they'll use it effectively. Investors back operations that can scale.

Stop scrambling when opportunity calls. Stop defending your data quality instead of showcasing your growth potential. Stop letting operational questions overshadow your strategic vision.