Connect Insurance + Wealth Data

Connect Insurance + Wealth Data

Connect Insurance + Wealth Data

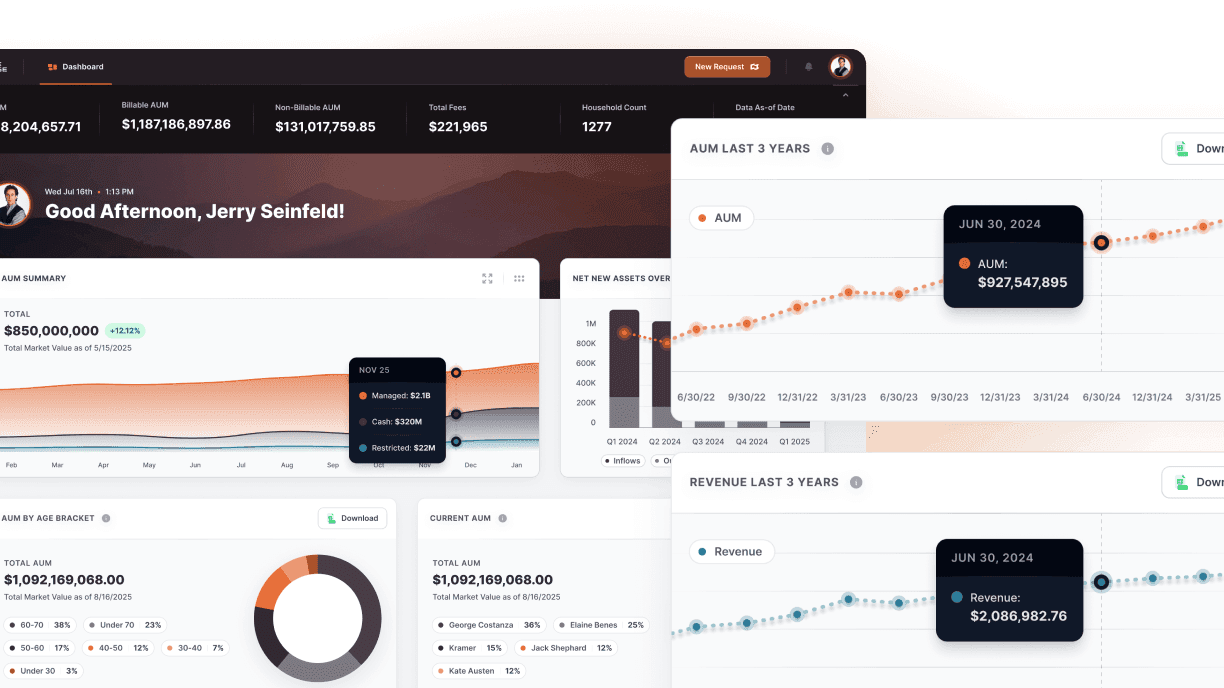

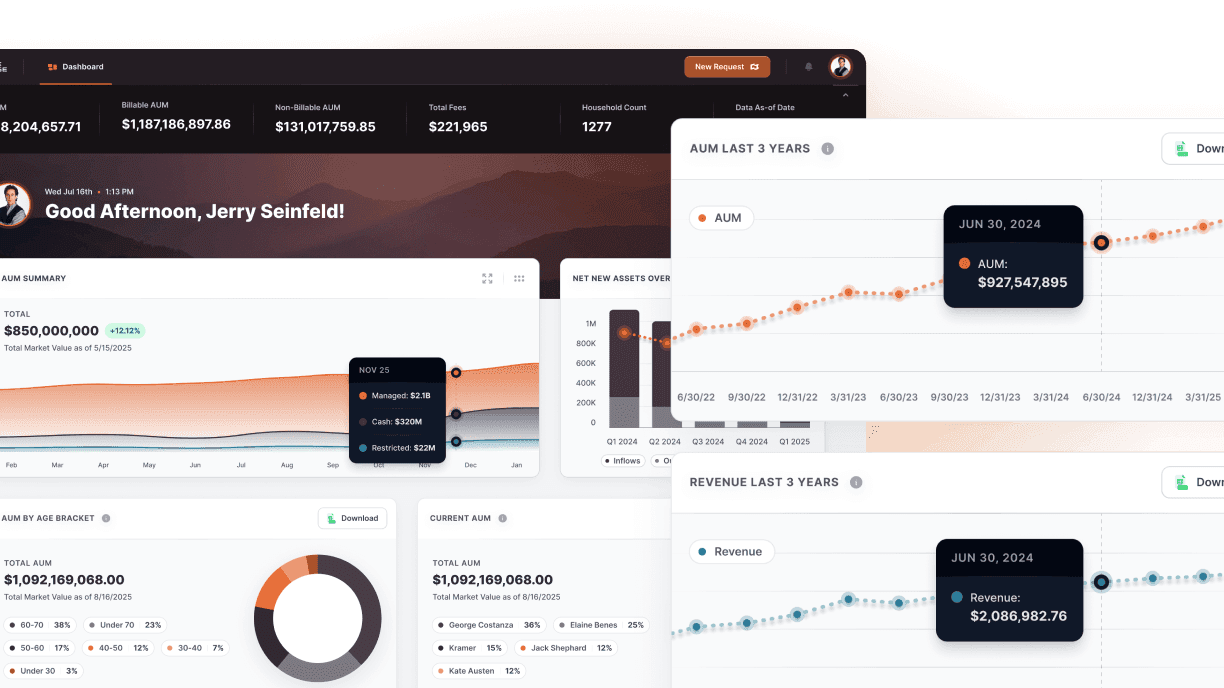

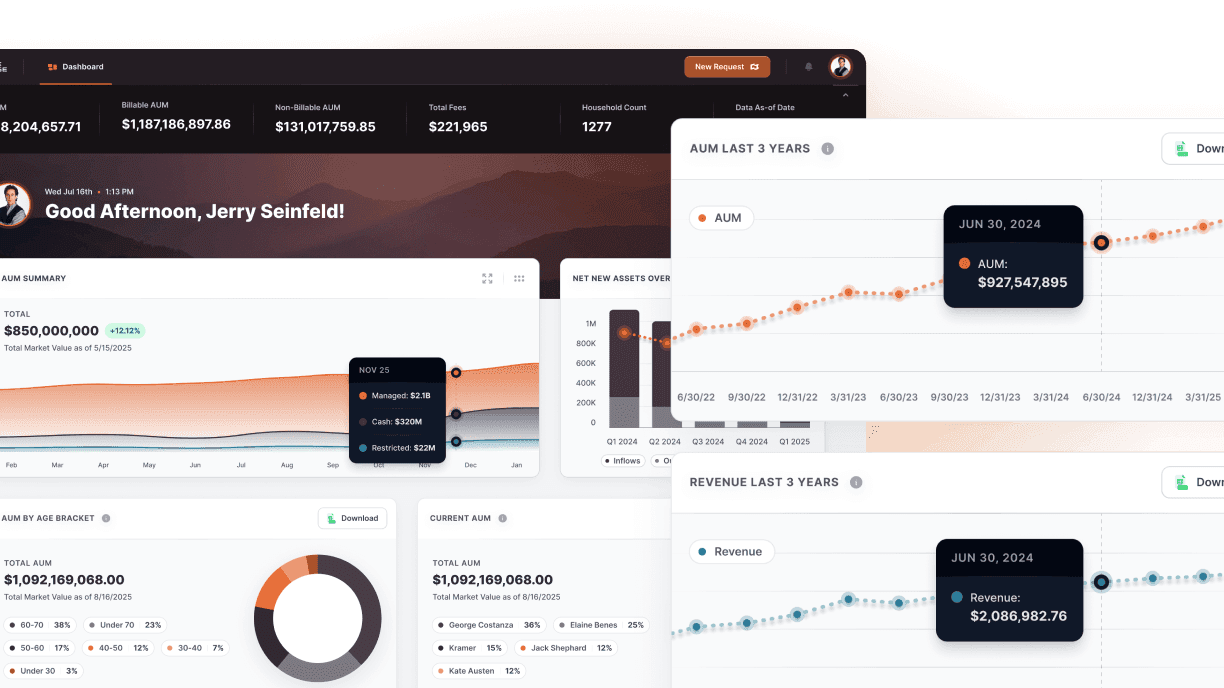

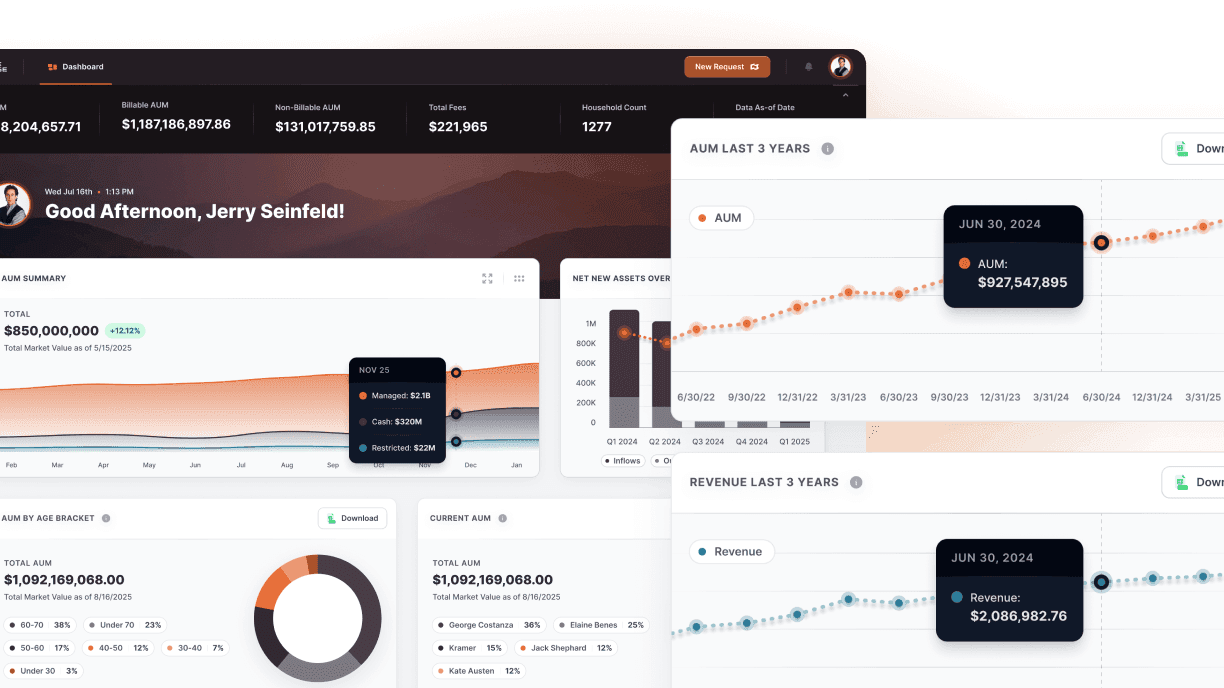

One view of every relationship. Finally, distribution insights that matter.

One view of every relationship. Finally, distribution insights that matter.

One view of every relationship. Finally, distribution insights that matter.

Milemarker™ redefines how insurance data reaches advisors.

Milemarker™ redefines how insurance data reaches advisors.

Milemarker™ redefines how insurance data reaches advisors.

Expensive Pipes. Dirty Water.

Monday morning. Competitive intelligence meeting.

“Northwestern just dropped their rates 50 basis points. Do our advisors know our new positioning?”

Check the data exchange. Last update: three weeks ago. Status: “processing.”

Wednesday. Product launch crisis.

“Our new annuity should be live on advisor platforms. Why can’t RIAs find it?”

Call the data vendor. “Technical issues with the transmission.” ETA for fix: unknown.

Friday. Market opportunity missed.

“That $500M RIA was comparing our product to competitors. They couldn’t get our current rates.”

You're losing business to data transmission failures, not product failures.

The Inferior Exchange Problem

Integration Isolation

RIAs use 12+ systems daily. Your funds exist in none of them. Manual uploads and spreadsheet exports make you look dated.

Data Disconnection

Advisors can’t access your research, performance data, or fund updates where they work. Your insights die in email attachments.

Distribution Blindness

You don’t know which RIAs use your funds, how they position them, or why they redeem. Flying blind in competitive battles.

Operational Friction

Every touchpoint with advisors requires manual work. From onboarding to reporting to communication. Competitors automate what you manually manage.

Your distribution strategy is fighting a data war with analog weapons.

The Inferior Exchange Problem

Integration Isolation

RIAs use 12+ systems daily. Your funds exist in none of them. Manual uploads and spreadsheet exports make you look dated.

Data Disconnection

Advisors can’t access your research, performance data, or fund updates where they work. Your insights die in email attachments.

Distribution Blindness

You don’t know which RIAs use your funds, how they position them, or why they redeem. Flying blind in competitive battles.

Operational Friction

Every touchpoint with advisors requires manual work. From onboarding to reporting to communication. Competitors automate what you manually manage.

Your distribution strategy is fighting a data war with analog weapons.

Direct, Intelligent Data Transmission

Direct, Intelligent Data Transmission

Real-Time Pipeline

Real-Time Pipeline

Your product updates, rate changes, and competitive positioning flow directly to advisor systems in real-time. No batching. No delays. No transmission failures.

Your product updates, rate changes, and competitive positioning flow directly to advisor systems in real-time. No batching. No delays. No transmission failures.

Universal Reach

Universal Reach

Connect to every advisor platform—major systems like Orion and Black Diamond, plus boutique RIA platforms and independent advisor tools the exchanges miss.

Connect to every advisor platform—major systems like Orion and Black Diamond, plus boutique RIA platforms and independent advisor tools the exchanges miss.

Guaranteed Delivery

Guaranteed Delivery

Your data reaches its destination accurately and completely. Built-in validation ensures advisors see exactly what you intended.

Your data reaches its destination accurately and completely. Built-in validation ensures advisors see exactly what you intended.

Complete Control

Complete Control

Monitor every transmission, track every update, and optimize every connection. Your data pipeline works for you, not against you.

Monitor every transmission, track every update, and optimize every connection. Your data pipeline works for you, not against you.

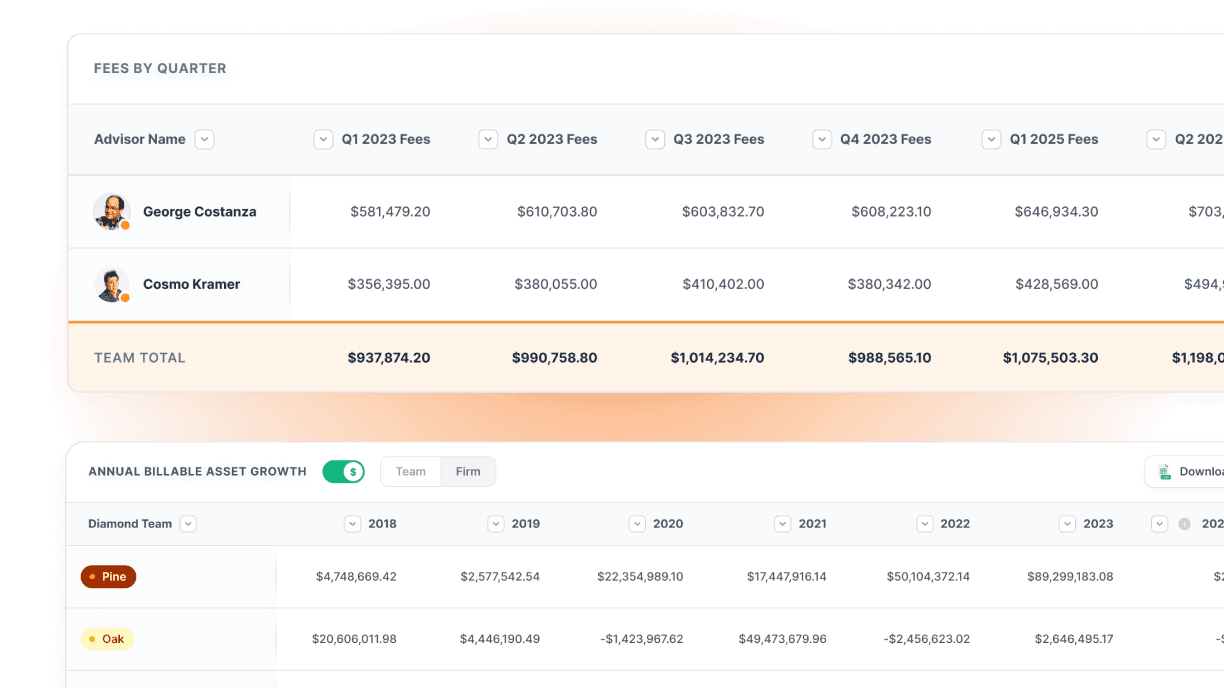

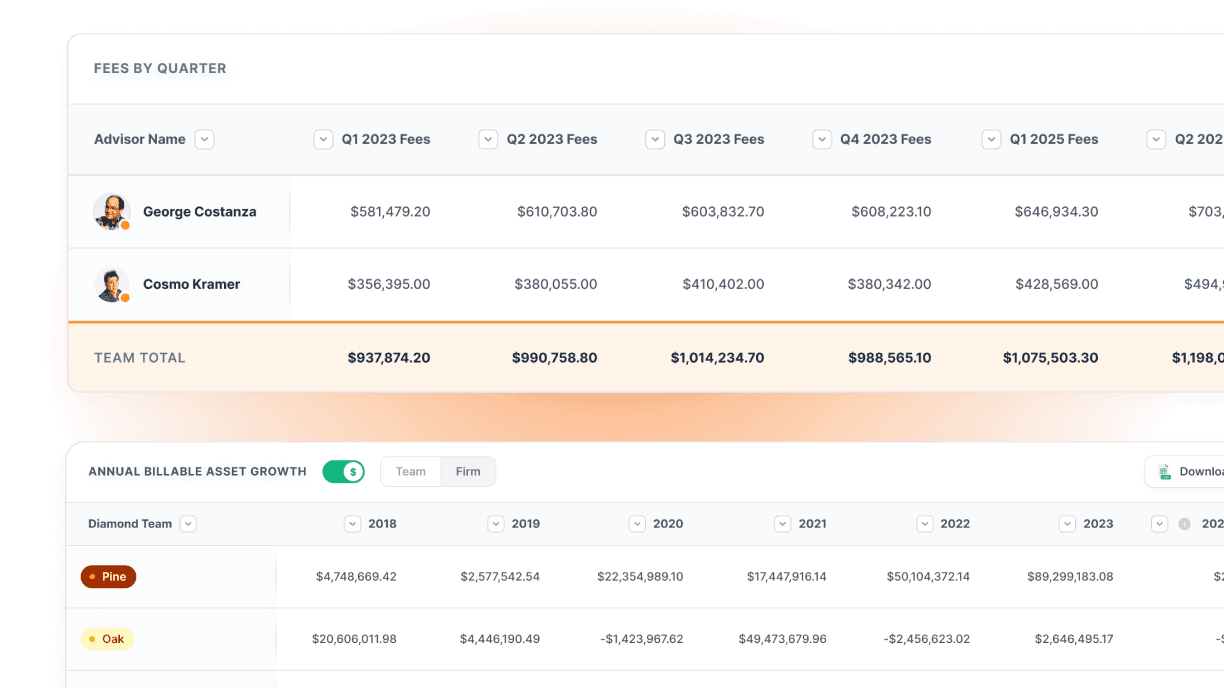

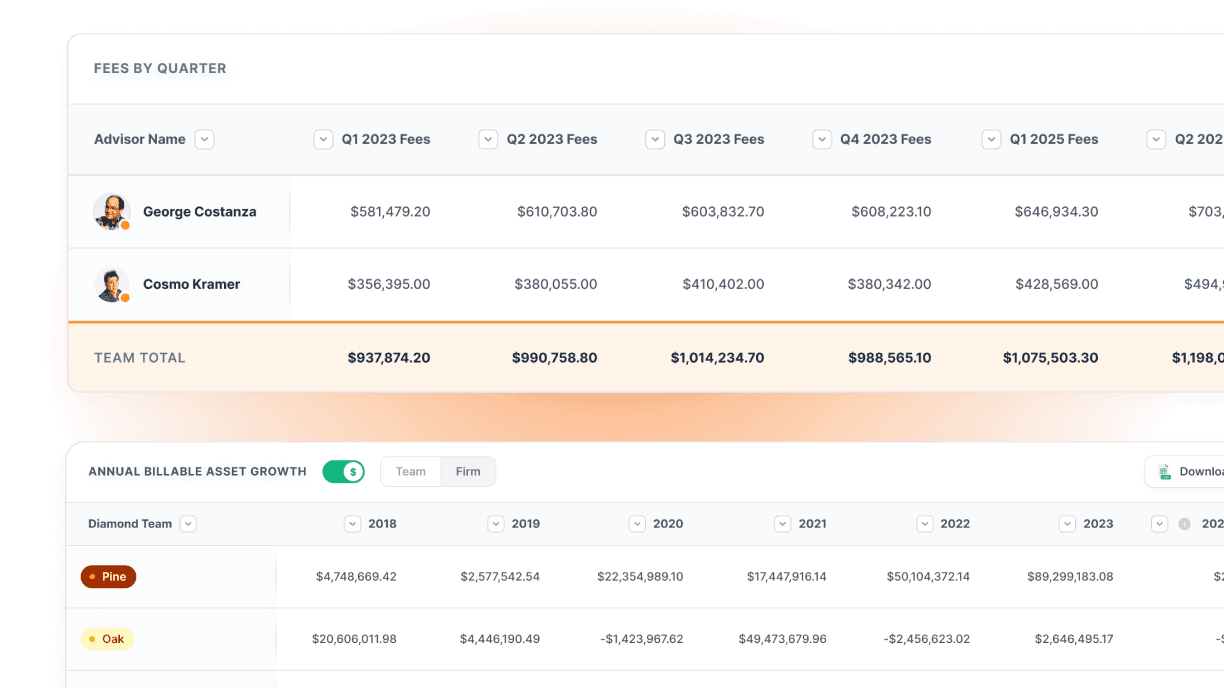

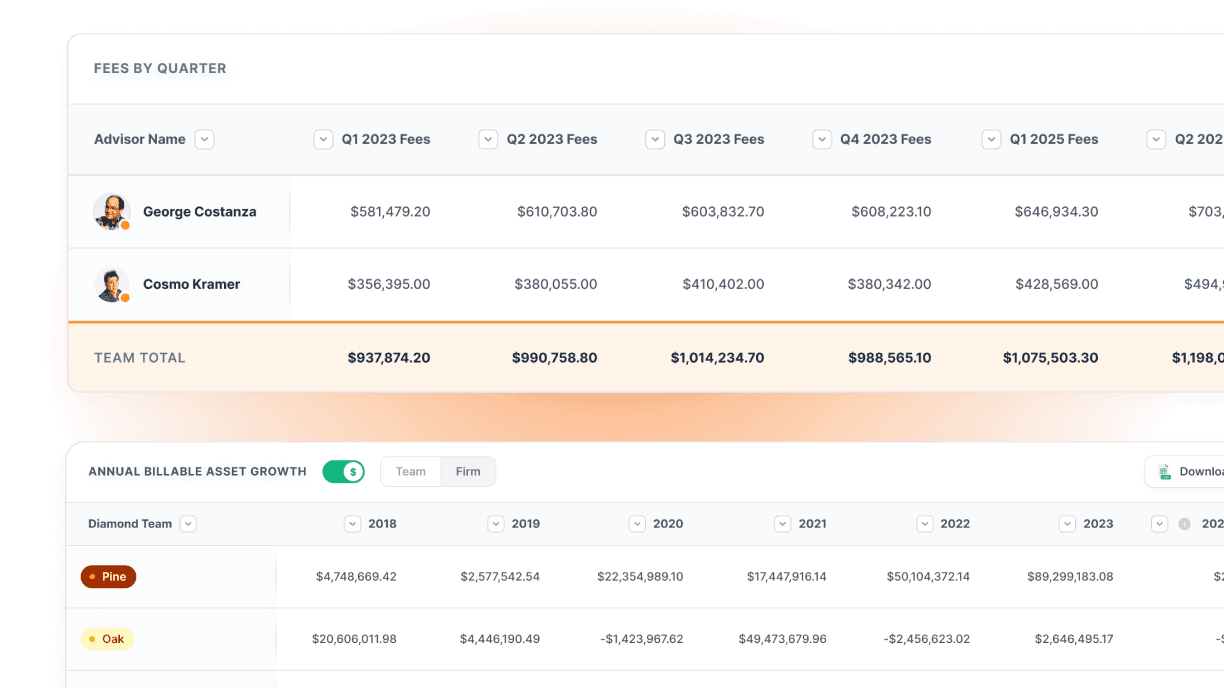

What You Get

Direct Advisor Platform Integration

Real-time data transmission to Orion, Black Diamond, Addepar & 130+ advisor systems

Immediate rate updates and & changes across all connected platforms

Automated competitive positioning updates triggered by market events

Universal reach including boutique RIA & independent advisor platforms

Market Intelligence Dashboard

Real-time visibility into advisor usage of your product data

Competitive positioning tracking across all advisor platforms

Opportunity identification based on advisor search & comparison patterns

Performance analytics showing which data drives advisor decisions

Transmission Control Center

Complete oversight of data flow across all advisor channels & platforms

Custom transmission rules based on advisor type, geography & specialization

Automated competitive response protocols triggered by market changes

Distribution optimization based on advisor engagement & conversion data

Advanced Market Analytics

Advisor behavior intelligence showing how your products are researched & positioned

Competitive displacement opportunity identification based on comparison patterns

Product development insights from advisor usage & feedback data

Market expansion opportunities through advisor platform analytics

The Transformation

The Transformation

The Transformation

Data Updates = Weeks Delayed Through Inferior Exchange Systems

Transmission Reliability = "Hope It Gets There Eventually"

Market Intelligence = Quarterly Reports From Exchange Vendors

Competitive Response = Reactive & Often Too Late

Data Updates = Weeks Delayed Through Inferior Exchange Systems

Transmission Reliability = "Hope It Gets There Eventually"

Market Intelligence = Quarterly Reports From Exchange Vendors

Competitive Response = Reactive & Often Too Late

Data Updates = Weeks Delayed Through Inferior Exchange Systems

Transmission Reliability = "Hope It Gets There Eventually"

Market Intelligence = Quarterly Reports From Exchange Vendors

Competitive Response = Reactive & Often Too Late

Data updates

real-time delivery to every advisor platform that matters

Transmission reliability

guaranteed delivery with validation & error correction

Market intelligence

live visibility into advisor behavior & product positioning

Competitive response

automated & immediate across all advisor touchpoints

Data updates

real-time delivery to every advisor platform that matters

Market intelligence

live visibility into advisor behavior & product positioning

Transmission reliability

guaranteed delivery with validation & error correction

Competitive response

automated & immediate across all advisor touchpoints

Data updates

real-time delivery to every advisor platform that matters

Market intelligence

live visibility into advisor behavior & product positioning

Transmission reliability

guaranteed delivery with validation & error correction

Competitive response

automated & immediate across all advisor touchpoints

Data updates

real-time delivery to every

advisor platform that matters

Market intelligence

live visibility into advisor

behavior & product positioning

Transmission reliability

guaranteed delivery with

validation & error correction

Competitive response

automated & immediate

across all advisor touchpoints

Real Results

Big fan of data and all Milemarker™ does.

Molly Pierce

CEO at Track That Advisor

Big fan of data and all Milemarker™ does.

Molly Pierce

CEO at Track That Advisor

Big fan of data and all Milemarker™ does.

Molly Pierce

CEO at Track That Advisor

Big fan of data and all Milemarker™ does.

Molly Pierce

CEO at Track That Advisor

90%

reduction in data transmission delays & failures

90%

reduction in data transmission delays & failures

90%

reduction in data transmission delays & failures

90%

reduction in data transmission delays & failures

100%

visibility into advisor usage & product positioning

100%

visibility into advisor usage & product positioning

100%

visibility into advisor usage & product positioning

100%

visibility into advisor usage & product positioning

300%

more connectivity to advisor platforms than traditional exchanges

300%

more connectivity to advisor platforms than traditional exchanges

300%

more connectivity to advisor platforms than traditional exchanges

300%

more connectivity to advisor platforms than traditional exchanges

Real-Time

competitive intelligence & automated market response

Real-Time

competitive intelligence & automated market response

Real-Time

competitive intelligence & automated market response

Real-Time

competitive intelligence & automated market response

Superior

Pipeline Features

Enterprise Data Transmission

Direct API connections bypassing traditional exchange bottlenecks

Real-time streaming protocols ensuring immediate advisor platform updates

Intelligent routing optimized for each advisor platform's specific requirements

Backup transmission paths ensuring guaranteed delivery even during system failures

Enterprise Data Transmission

Direct API connections bypassing traditional exchange bottlenecks

Real-time streaming protocols ensuring immediate advisor platform updates

Intelligent routing optimized for each advisor platform's specific requirements

Backup transmission paths ensuring guaranteed delivery even during system failures

Enterprise Data Transmission

Direct API connections bypassing traditional exchange bottlenecks

Real-time streaming protocols ensuring immediate advisor platform updates

Intelligent routing optimized for each advisor platform's specific requirements

Backup transmission paths ensuring guaranteed delivery even during system failures

Enterprise Data Transmission

Direct API connections bypassing traditional exchange bottlenecks

Real-time streaming protocols ensuring immediate advisor platform updates

Intelligent routing optimized for each advisor platform's specific requirements

Backup transmission paths ensuring guaranteed delivery even during system failures

Quality Assurance Controls

Pre-transmission validation preventing data corruption & formatting errors

Real-time monitoring detecting & correcting transmission issues automatically

Complete data lineage tracking from source to advisor platform delivery

Automated rollback capabilities for incorrect or corrupted transmissions

Quality Assurance Controls

Pre-transmission validation preventing data corruption & formatting errors

Real-time monitoring detecting & correcting transmission issues automatically

Complete data lineage tracking from source to advisor platform delivery

Automated rollback capabilities for incorrect or corrupted transmissions

Quality Assurance Controls

Pre-transmission validation preventing data corruption & formatting errors

Real-time monitoring detecting & correcting transmission issues automatically

Complete data lineage tracking from source to advisor platform delivery

Automated rollback capabilities for incorrect or corrupted transmissions

Quality Assurance Controls

Pre-transmission validation preventing data corruption & formatting errors

Real-time monitoring detecting & correcting transmission issues automatically

Complete data lineage tracking from source to advisor platform delivery

Automated rollback capabilities for incorrect or corrupted transmissions

Universal Platform Coverage

Direct integration with major platforms like Orion, Black Diamond, & Addepar

Connectivity to boutique RIA platforms & independent advisor systems

Custom integration capabilities for unique advisor technology stacks

Geographic expansion support for international advisor platforms

Universal Platform Coverage

Direct integration with major platforms like Orion, Black Diamond, & Addepar

Connectivity to boutique RIA platforms & independent advisor systems

Custom integration capabilities for unique advisor technology stacks

Geographic expansion support for international advisor platforms

Universal Platform Coverage

Direct integration with major platforms like Orion, Black Diamond, & Addepar

Connectivity to boutique RIA platforms & independent advisor systems

Custom integration capabilities for unique advisor technology stacks

Geographic expansion support for international advisor platforms

Universal Platform Coverage

Direct integration with major platforms like Orion, Black Diamond, & Addepar

Connectivity to boutique RIA platforms & independent advisor systems

Custom integration capabilities for unique advisor technology stacks

Geographic expansion support for international advisor platforms

Competitive Intelligence Integration

Real-time competitive product monitoring & automated response protocols

Advisor comparison behavior tracking showing competitive positioning effectiveness

Market share analysis based on advisor platform usage & selection patterns

Win/loss intelligence providing specific reasons for advisor product choices

Competitive Intelligence Integration

Real-time competitive product monitoring & automated response protocols

Advisor comparison behavior tracking showing competitive positioning effectiveness

Market share analysis based on advisor platform usage & selection patterns

Win/loss intelligence providing specific reasons for advisor product choices

Competitive Intelligence Integration

Real-time competitive product monitoring & automated response protocols

Advisor comparison behavior tracking showing competitive positioning effectiveness

Market share analysis based on advisor platform usage & selection patterns

Win/loss intelligence providing specific reasons for advisor product choices

Competitive Intelligence Integration

Real-time competitive product monitoring & automated response protocols

Advisor comparison behavior tracking showing competitive positioning effectiveness

Market share analysis based on advisor platform usage & selection patterns

Win/loss intelligence providing specific reasons for advisor product choices

Built For

Modern Insurance Distribution

Enterprise Infrastructure

SOC 2 Type II compliant platform with enterprise-grade security meeting insurance industry regulatory requirements.

Enterprise Infrastructure

SOC 2 Type II compliant platform with enterprise-grade security meeting insurance industry regulatory requirements.

Enterprise Infrastructure

SOC 2 Type II compliant platform with enterprise-grade security meeting insurance industry regulatory requirements.

Enterprise Infrastructure

SOC 2 Type II compliant platform with enterprise-grade security meeting insurance industry regulatory requirements.

Scalable

Architecture

Support unlimited advisor connections with performance optimization ensuring fast, reliable data delivery at any scale.

Scalable Architecture

Support unlimited advisor connections with performance optimization ensuring fast, reliable data delivery at any scale.

Scalable

Architecture

Support unlimited advisor connections with performance optimization ensuring fast, reliable data delivery at any scale.

Scalable

Architecture

Support unlimited advisor connections with performance optimization ensuring fast, reliable data delivery at any scale.

Regulatory

Compliance

Complete audit trails, data governance controls, and compliance monitoring built for insurance industry oversight.

Regulatory Compliance

Complete audit trails, data governance controls, and compliance monitoring built for insurance industry oversight.

Regulatory

Compliance

Complete audit trails, data governance controls, and compliance monitoring built for insurance industry oversight.

Regulatory

Compliance

Complete audit trails, data governance controls, and compliance monitoring built for insurance industry oversight.

Integration

Leadership

Connect to any advisor platform, normalize any data format, and optimize any transmission protocol.

Integration Leadership

Connect to any advisor platform, normalize any data format, and optimize any transmission protocol.

Integration

Leadership

Connect to any advisor platform, normalize any data format, and optimize any transmission protocol.

Integration

Leadership

Connect to any advisor platform, normalize any data format, and optimize any transmission protocol.

Advanced

Intelligence Capabilities

Predictive Market Analysis

Forecast advisor demand for products based on platform usage & search patterns

Predict competitive threats & optimize preemptive positioning strategies

Risk overlay integration with advisor risk management

Optimize product development priorities using advisor engagement intelligence

Distribution Optimization

Advisor channel effectiveness analysis showing highest-converting platforms & relationships

Geographic & demographic optimization based on advisor platform analytics

Resource allocation guidance maximizing ROI across distribution channels

Partnership evaluation identifying most valuable advisor platform integrations

Real-Time Market Response

Automated competitive positioning updates across all advisor platforms simultaneously

Dynamic pricing & positioning optimization based on real-time market intelligence

Crisis response protocols ensuring immediate message coordination across all channels

Market opportunity capitalization through immediate advisor notification systems

Why Direct Control Changes Everything

Your advisors are investment professionals. Their tools should reflect that.

Build the direct pipeline that puts you in control of your market presence.

Stop accepting transmission failures as normal.

Stop accepting transmission failures as normal.

Stop accepting transmission failures as normal.

Stop accepting transmission failures as normal.

Stop losing market opportunities to data delays.

Stop losing market opportunities to data delays.

Stop losing market opportunities to data delays.

Stop losing market opportunities to data delays.

Stop paying for infrastructure that works against your growth.

Stop paying for infrastructure that works against your growth.

Stop paying for infrastructure that works against your growth.

Stop paying for infrastructure that works against your growth.

Ready to Redefine Your Data Pipeline?

Free analysis of transmission failures and missed opportunities in your current data distribution.

Watch real-time data transmission that eliminates exchange failures.

Ready to Redefine Your Data Pipeline?

Free analysis of transmission failures and missed opportunities in your current data distribution.

Watch real-time data transmission that eliminates exchange failures.

Ready to Redefine Your Data Pipeline?

Free analysis of transmission failures and missed opportunities in your current data distribution.

Watch real-time data transmission that eliminates exchange failures.

Ready to Redefine Your Data Pipeline?

Free analysis of transmission failures and missed opportunities in your current data distribution.

Watch real-time data transmission that eliminates exchange failures.

Phone

+1 (470) 502-5600

Mailing Address

Milemarker

PO Box 262

Isle Of Palms, SC 29451-9998

Legal Address

Milemarker Inc.

16192 Coastal Highway

Lewes, Delaware 19958

Built by Teams In:

Atlanta, Charleston, Cincinnati, Denver, Los Angeles, Omaha & Portland.

Partners

Platform

Solutions

© 2026 Milemarker Inc. All rights reserved

DISCLAIMER: All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.

Phone

+1 (470) 502-5600

Mailing Address

Milemarker

PO Box 262

Isle Of Palms, SC 29451-9998

Legal Address

Milemarker Inc.

16192 Coastal Highway

Lewes, Delaware 19958

Built by Teams In:

Atlanta, Charleston, Cincinnati, Denver, Los Angeles, Omaha & Portland.

Partners

Platform

Solutions

© 2026 Milemarker Inc. All rights reserved

DISCLAIMER: All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.

Phone

+1 (470) 502-5600

Mailing Address

Milemarker

PO Box 262

Isle Of Palms, SC 29451-9998

Legal Address

Milemarker Inc.

16192 Coastal Highway

Lewes, Delaware 19958

Built by Teams In:

Atlanta, Charleston, Cincinnati, Denver, Los Angeles, Omaha & Portland.

Partners

Platform

Solutions

© 2026 Milemarker Inc. All rights reserved

DISCLAIMER: All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.

Phone

+1 (470) 502-5600

Mailing Address

Milemarker

PO Box 262

Isle Of Palms, SC 29451-9998

Legal Address

Milemarker Inc.

16192 Coastal Highway

Lewes, Delaware 19958

Built by Teams In:

Atlanta, Charleston, Cincinnati, Denver, Los Angeles, Omaha & Portland.

Partners