Great Investments. Fragmented Intelligence.

Monday morning. Portfolio review meeting.

"How's advisor productivity trending across our RIA investments?"

Three hours compiling data from 8 different firms. Different metrics. Inconsistent definitions.

Wednesday. Investment committee.

"Which firms are actually growing organically vs. just doing acquisitions?"

Phone calls to portfolio company CFOs. Hope their numbers are current. Hope they're using the same definitions.

Friday. LP reporting deadline.

"We need to show value creation across the wealth management portfolio."

Another weekend building reports that are outdated before they're finished.

Your wealth management intelligence is trapped in operational chaos.

What You Get

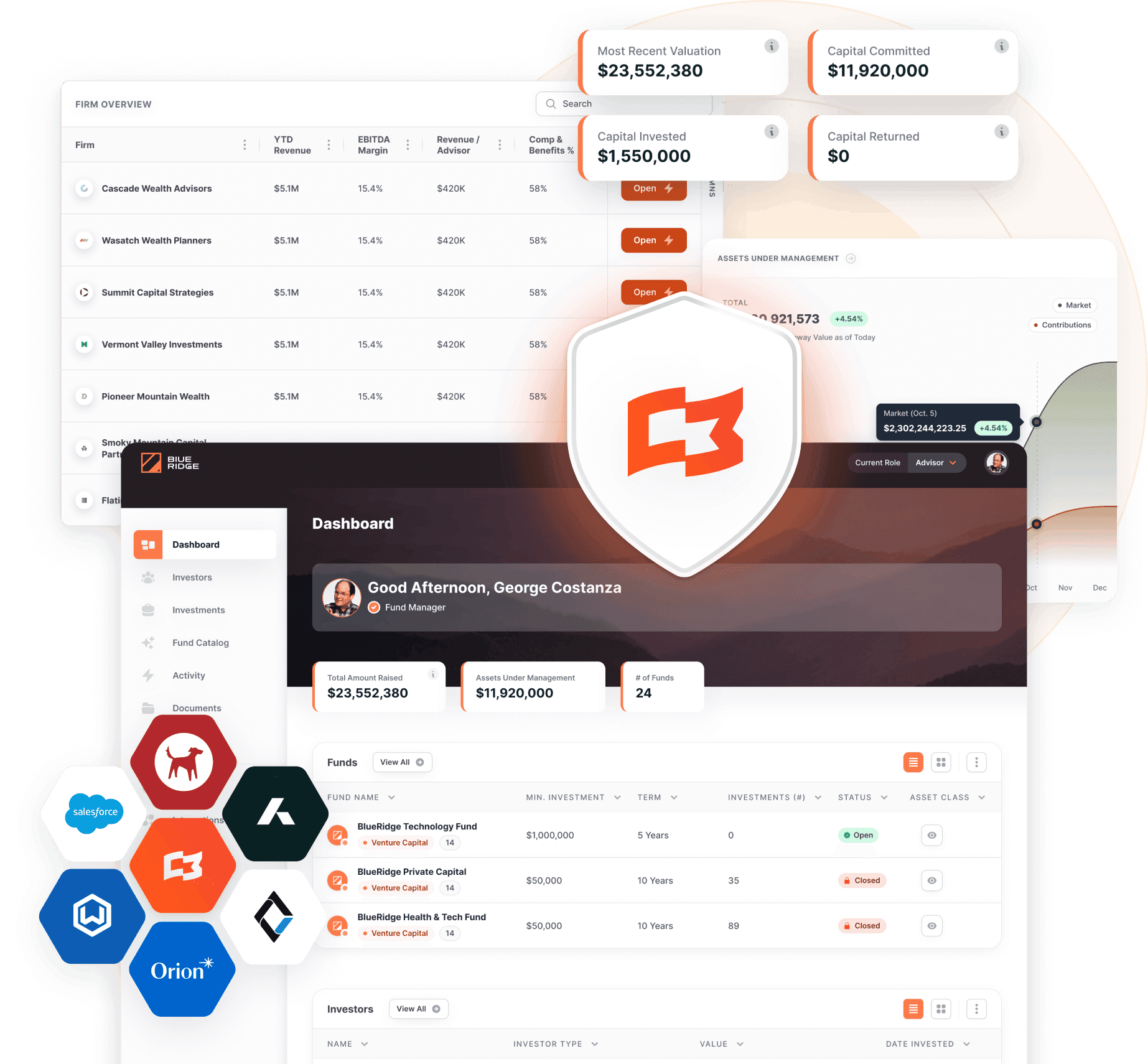

Unified Investment Universe

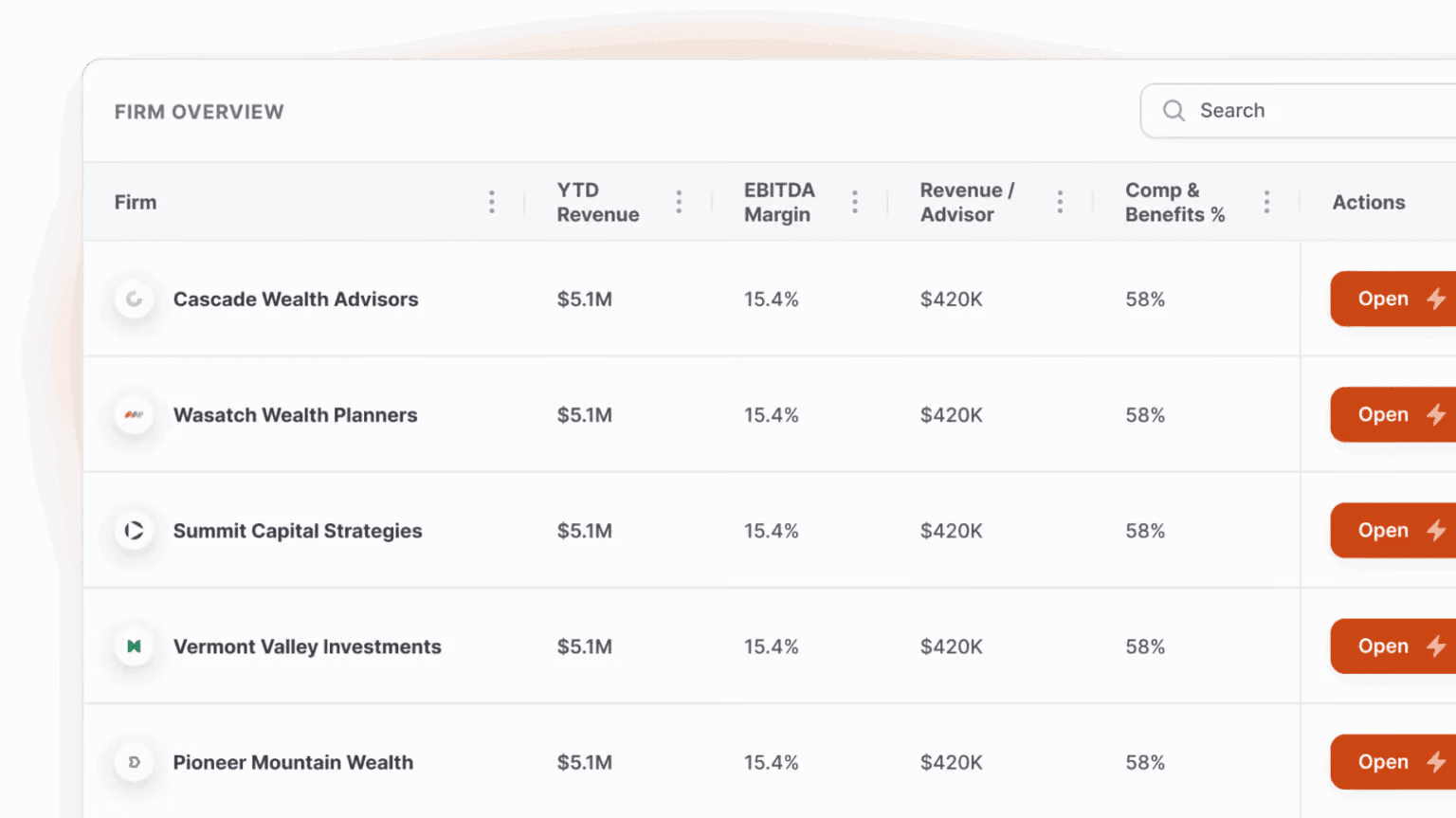

Wealth Management Portfolio Unification

Real-time consolidation of AUM growth, advisor retention & client satisfaction metrics

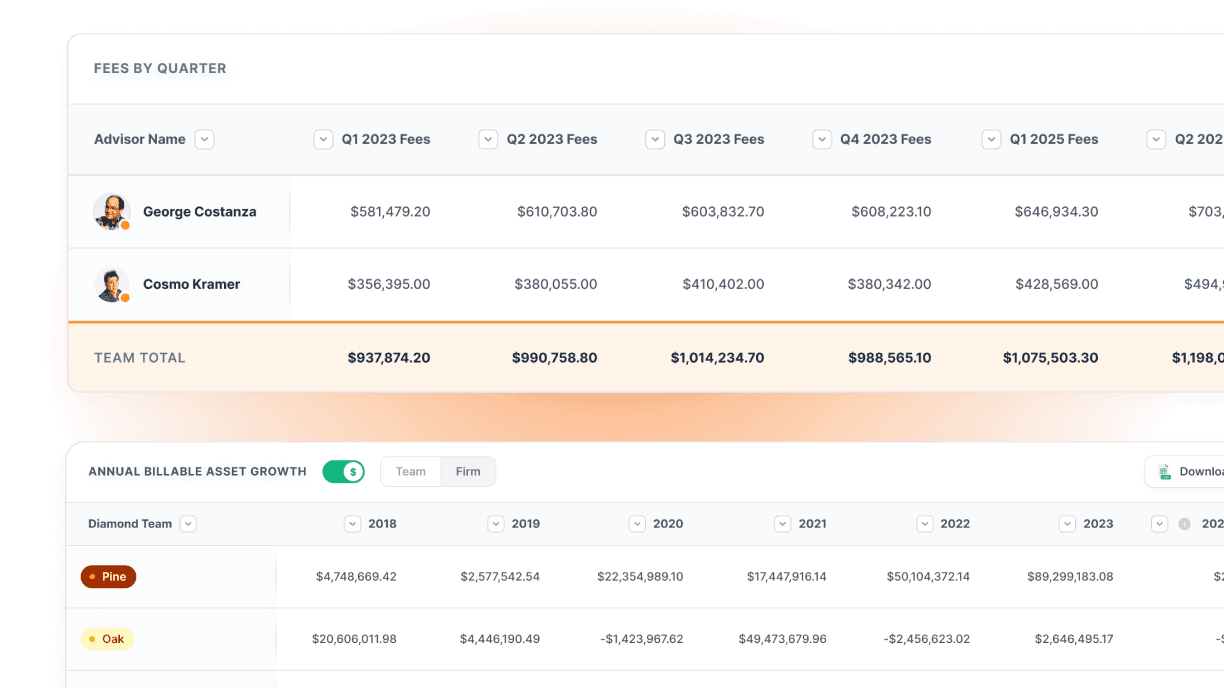

Normalized advisor productivity, client metrics & revenue tracking across different firm types

Single source of truth for all wealth management portfolio company performance

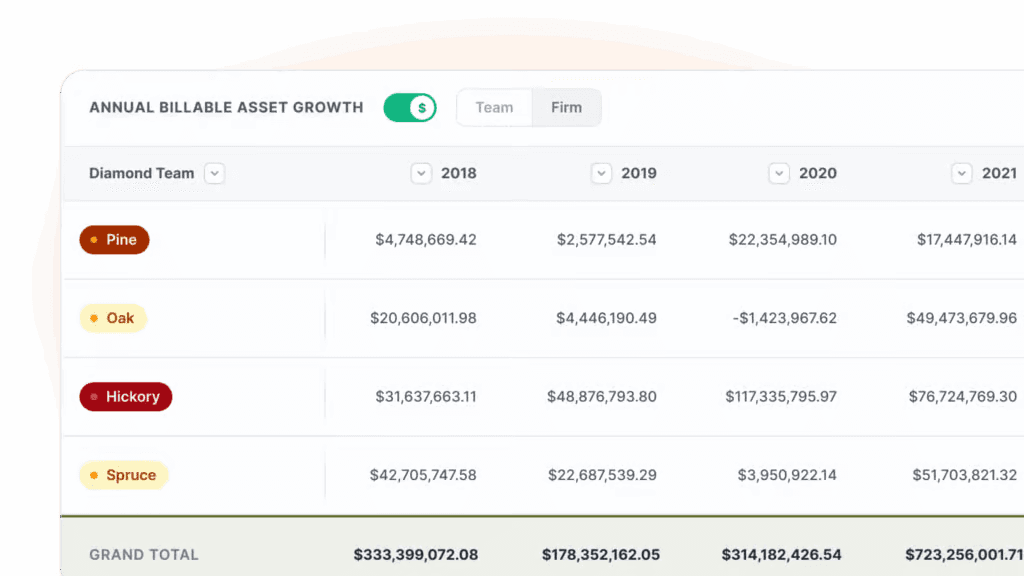

Advanced Cross-Firm Analytics

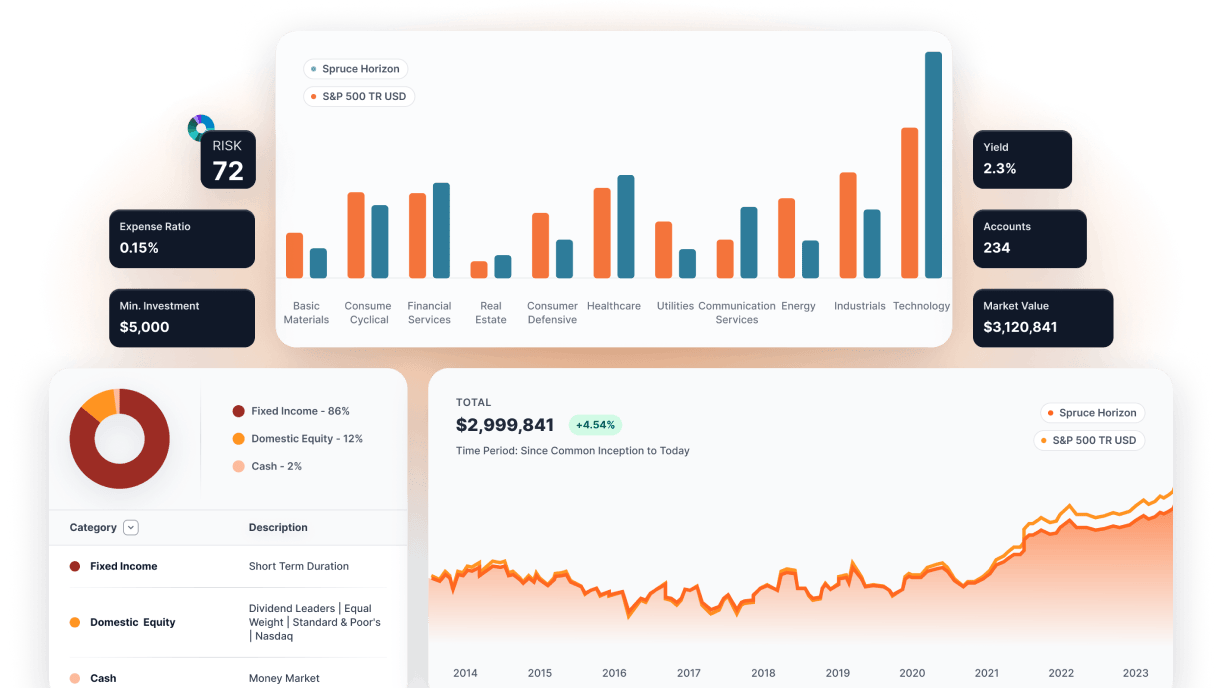

Benchmark analysis comparing advisor productivity across similar RIAs & market segments

Cohort analysis tracking performance by firm type, geography & investment vintage

Pattern recognition identifying successful wealth management strategies & operational improvements

Predictive modeling showing which firms are trending toward outperformance or operational challenges

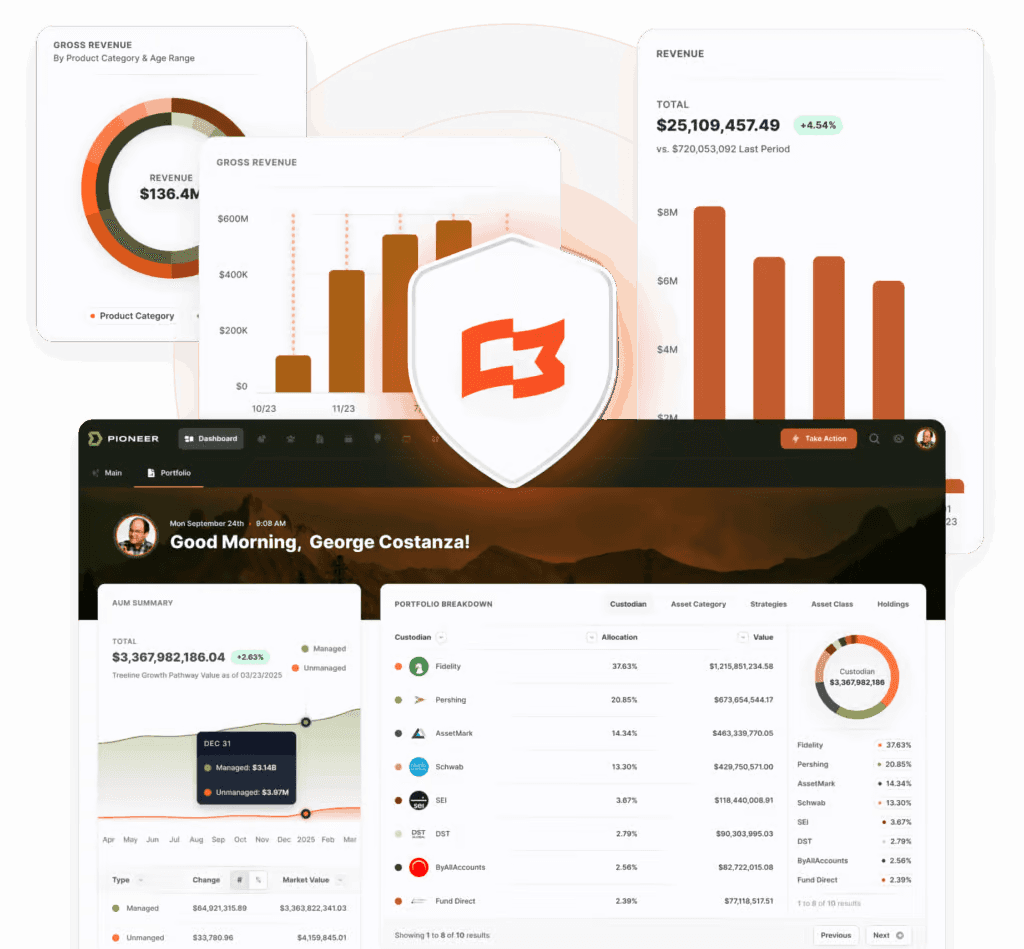

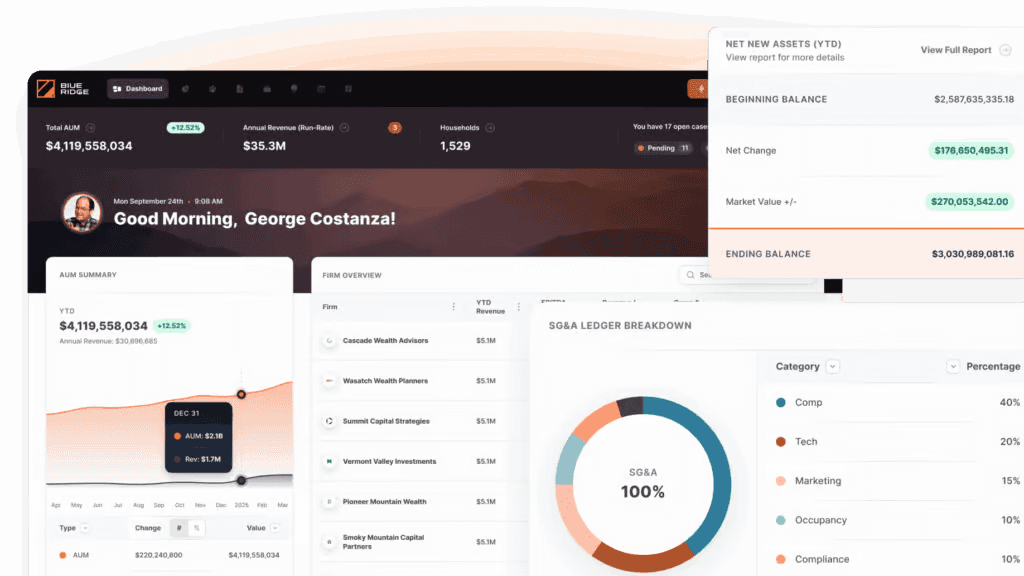

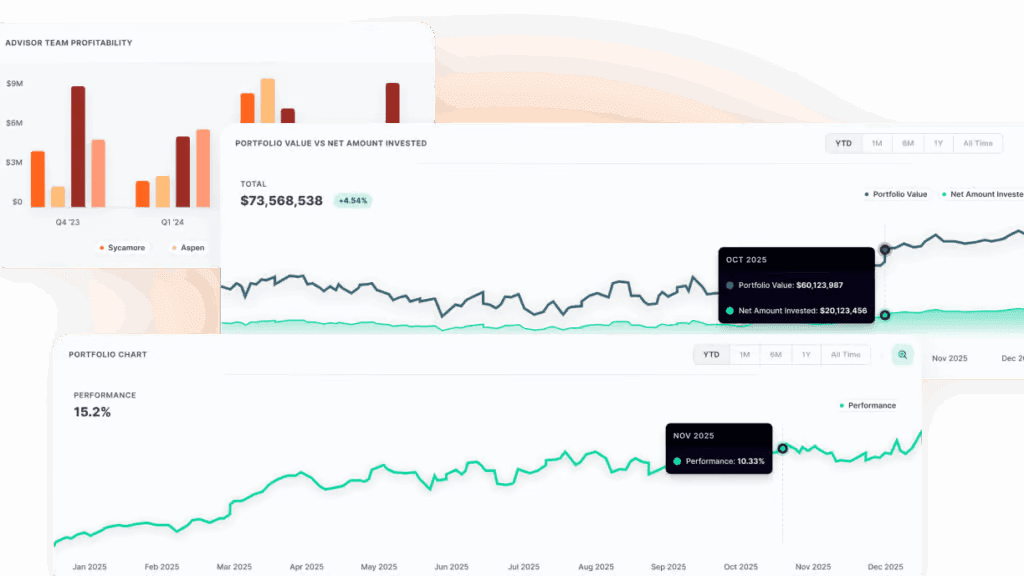

Executive Intelligence Dashboard

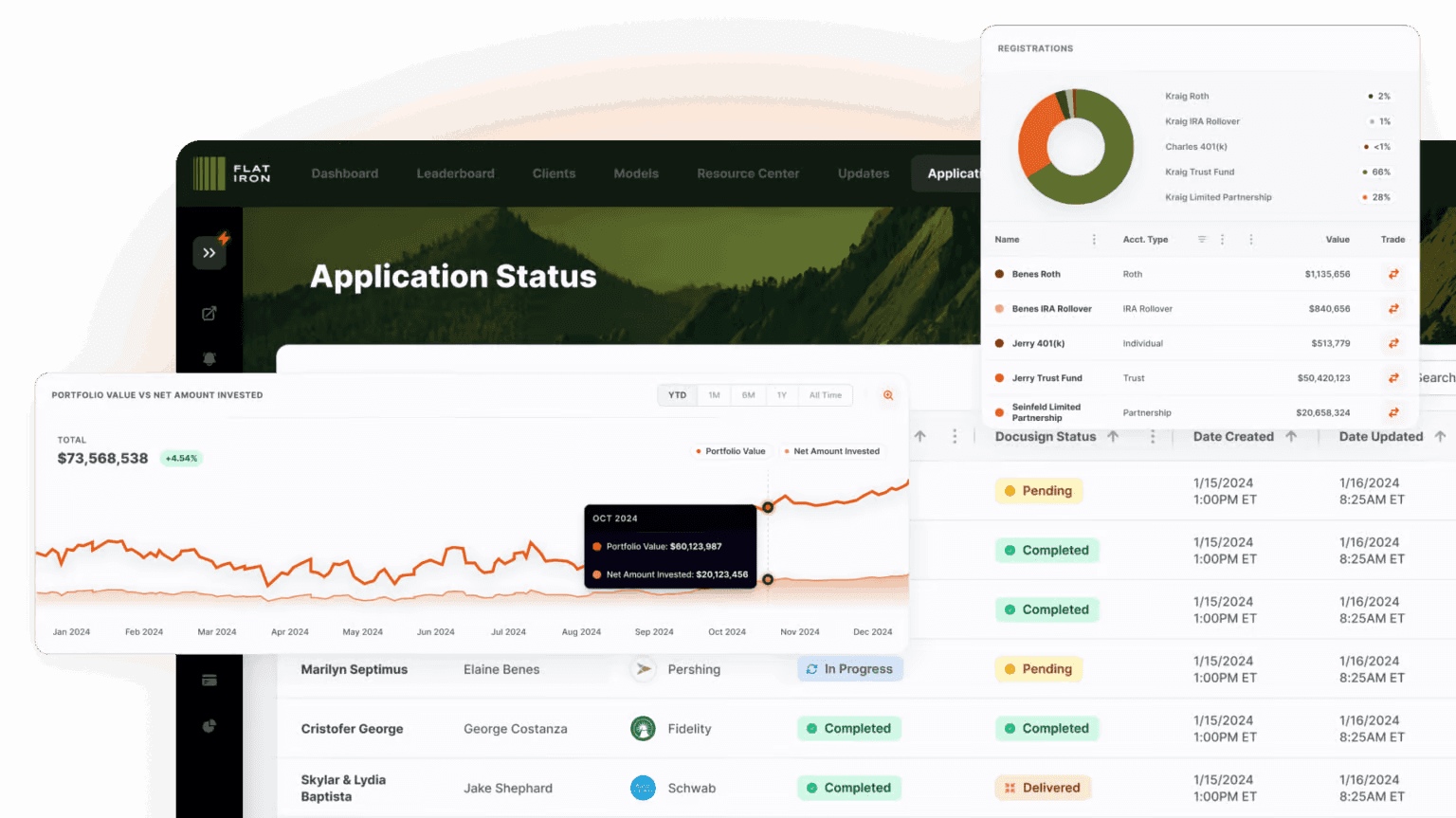

Real-time portfolio performance visibility with drill-down capabilities to individual firms & advisor teams

Investment thesis tracking showing how wealth management firms perform against original growth projections

Exception monitoring alerting to firms requiring immediate attention, operational support, or additional investment

LP reporting automation with wealth management industry benchmarks & institutional-grade documentation

Wealth Management Value Creation

Best practice identification from top-performing RIAs & wealth management firms

Strategic initiative tracking showing ROI of technology investments, acquisition strategies & operational changes

Operational improvement opportunity mapping across advisor productivity, client experience & technology adoption

Resource allocation optimization based on wealth management-specific value creation potential

Cross-Portfolio Learning for Wealth Management

Success pattern analysis showing which value creation strategies drive the best returns in wealth management

M&A intelligence aggregated from portfolio company acquisition experiences & integration successes

Technology adoption insights identifying high-impact platforms & operational improvements across firms

Market positioning analysis showing competitive advantages & differentiation strategies that work

Portfolio analysis = manual data compilation from RIAs, TAMPs & BDs taking weeks

Value creation = intuition-based decisions with limited visibility into what actually works

Firm support = reactive responses to problems already impacting advisor productivity

LP reporting = quarterly scrambles with inconsistent wealth management metrics

Portfolio analysis

real-time dashboards with instant drill-down across all wealth management firms

Value creation

data-driven strategies based on proven cross-portfolio wealth management patterns

Firm support

proactive intervention based on advisor productivity analytics & benchmarking

LP reporting

automated generation with real-time wealth management data & transparent methodologies

Real Results

Wealth Management

PE-Specific Capabilities

RIA & Wealth Management Integration

Seamless connectivity to CRM systems (Salesforce, Wealthbox, Redtail), portfolio platforms (Orion, Black Diamond) & custodial data

Client experience measurement & satisfaction tracking across portfolio companies

Automated advisor productivity tracking with normalized metrics across different firm types & business models

Technology adoption monitoring showing ROI of platform investments & operational improvements

Wealth Management Value Creation Analytics

Cross-firm benchmarking showing relative performance in advisor productivity, client retention & revenue growth

Resource allocation optimization based on wealth management-specific value creation opportunities

Best practice identification from successful operational improvements, technology deployments & acquisition strategies

Strategic initiative ROI analysis with success factor identification for technology, talent & operational investments

Investment Monitoring for Wealth Management

Real-time performance tracking against wealth management investment thesis & projected returns

Growth acceleration opportunity identification based on successful portfolio company expansion strategies

Early warning systems for firms trending toward advisor attrition, client dissatisfaction, or operational challenges

Exit readiness assessment with wealth management valuation optimization & market timing recommendations

Wealth Management LP Reporting

Automated quarterly reporting with wealth management industry benchmarks & competitive positioning

Performance attribution analysis showing value creation sources specific to wealth management investments

Customizable portfolio views showing advisor productivity, client metrics & operational efficiency across firms

Market intelligence based on aggregated portfolio company performance & competitive dynamics

Built For

Wealth Management PE Scale

Advanced Wealth Management

Portfolio Intelligence

Why Wealth Management Portfolio Unification Changes Everything

Your wealth management investments are only as strong as your ability to optimize them. Every missed operational pattern is a missed value creation opportunity.

Build the unified intelligence that maximizes every wealth management investment.